Time to get real on interest rates

As interest rates continue to rise, we need to consider why.

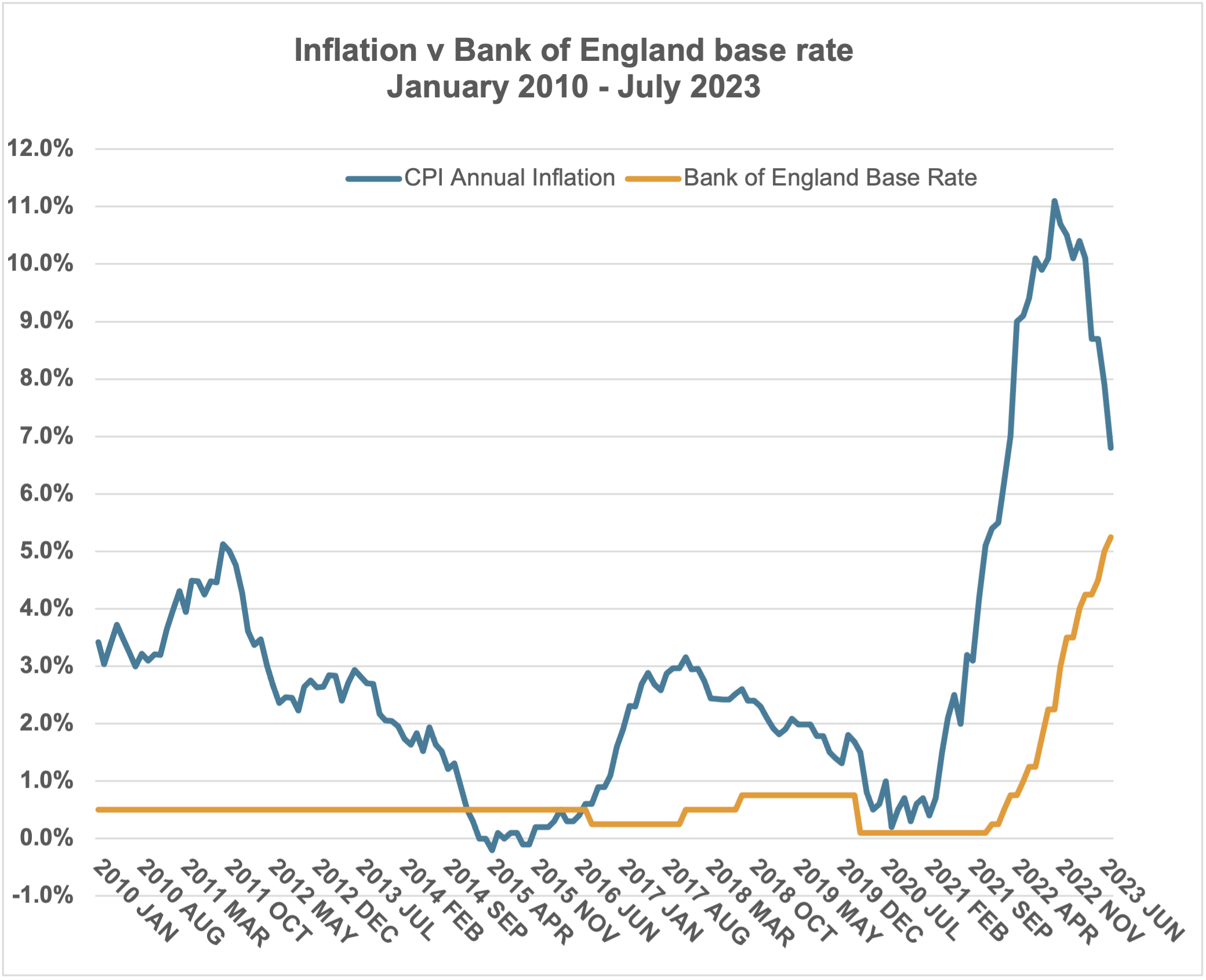

Source: Bank of England, National Statistics

Cast your mind back to July 2020. Covid-19 was creating massive social and economic disruption, reflected in a Bank of England interest rate of just 0.1% and instant access savings rates were little more than 1%. Three years later, the Bank of England rate had increased to 5% and some savings accounts were offering about 4.4%.

Which was the better time to have cash on deposit?

The obvious answer would be July 2023, but there is a case for saying that July 2020 was in fact better for savers. The reason is simple: inflation. In July 2020, CPI inflation was running at 1.0%, whereas in July 2023, it was 6.8%. One way investment professionals look at interest rates is to take the nominal headline figure and subtract the going rate of inflation to arrive at a ‘real’ interest rate. Do that, and July 2020 delivered a very small positive real interest rate (1.1% – 1.0% = 0.1%), while July 2023 had a negative ‘real’ rate of over 2% (4.4% – 6.8% = -2.4%). When real rates are below zero, the message is that inflation is eroding your cash quicker than accumulating interest is growing it.

Bank of England’s base interest rate has rarely been higher than inflation

Tax has been ignored here to keep things simple, but tax too has become much more relevant to savings interest. The £1,000 personal savings allowance for basic rate taxpayers covered interest from a £100,000 deposit when rates were at 1%: now at, say, 4%, the corresponding figure is £25,000 and for higher rate taxpayers those cash figures halve. As the graph shows, since the start of 2010, the Bank of England’s base rate has rarely been higher than inflation. Although easy access rates do not precisely match the Bank’s rate, generally the two do not move far apart. So, since 2010, instant access accounts have lost their savers buying power, even with all interest reinvested. While interest rates are higher now than in the 2010s – and gaining plenty of attention – inflation is higher still.

Cash on deposit is risky in times of high inflation

The unhappy mathematics of real interest rates do not mean you should avoid cash deposits at all costs. Beyond the obvious need for rainy day money there are plenty of other reasons to retain some readily available funds earning interest. However, the more of your wealth that you hold on deposit, the more you must have good reasons for doing so.

Disclaimer

Tax treatment varies according to individual circumstances and is subject to change.

The Financial Conduct Authority does not regulate tax advice.

For specialist tax advice, please refer to an accountant or tax specialist.

HM Revenue and Customs practice and the law relating to taxation are complex and subject to individual circumstances and changes which cannot be foreseen.

Get in touch

Fill in the form below and a member of the team will be in touch