So farewell then inheritance tax? Not so fast

Is Downing Street really planning to abolish inheritance tax?

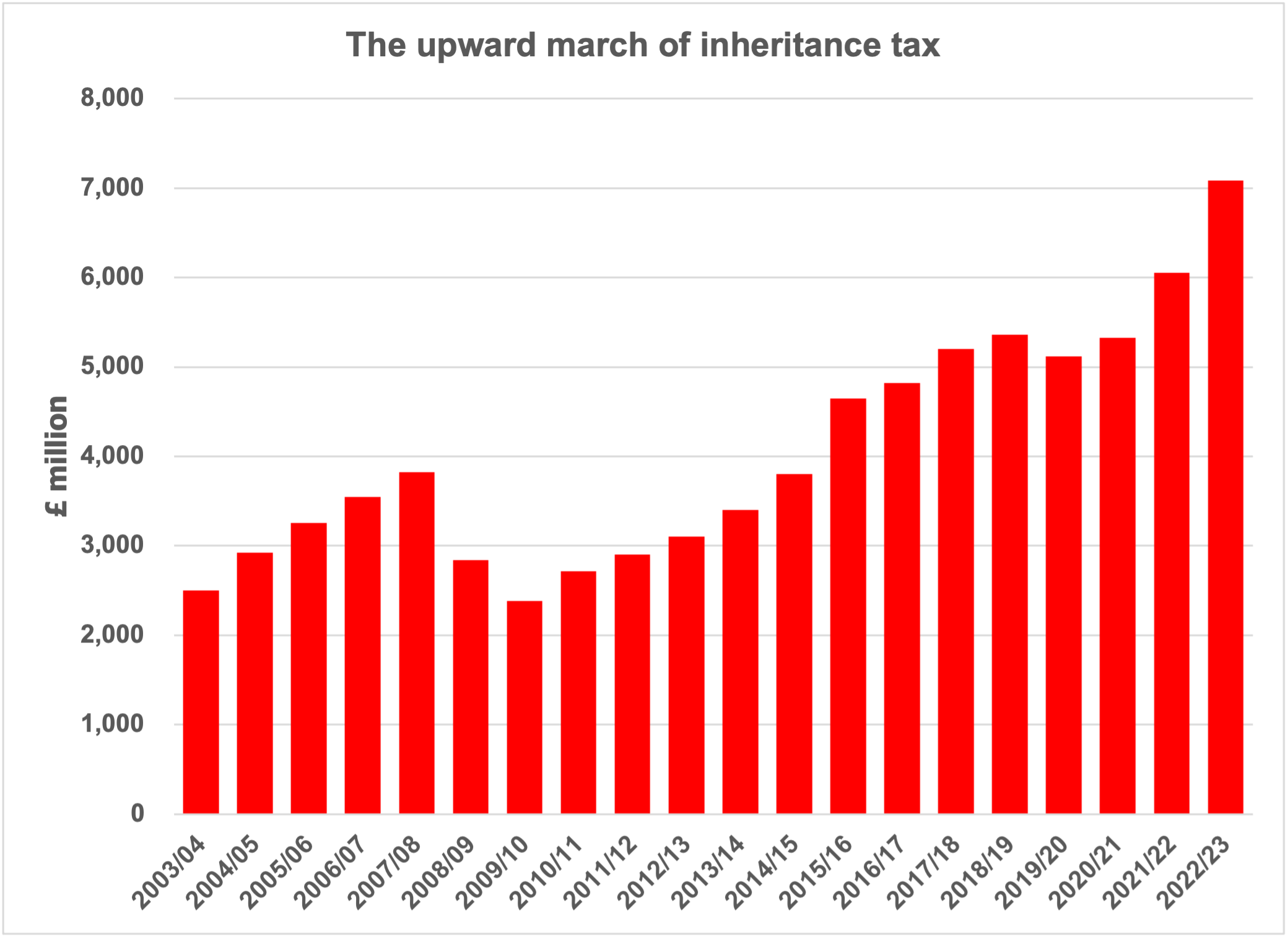

Source: HMRC

Shortly before the so-called ‘silly season’ (Parliament’s summer recess) got underway, several newspapers carried stories that Downing Street was considering the abolition of inheritance tax (IHT) in an attempt to appeal to certain voters. The speculation did not last for long before the Uxbridge by-election result shifted the debate towards environmental concerns instead. However, it seems likely that the question of culling IHT will re-emerge as we head towards the next general election.

Inheritance tax growth

As the graph shows, receipts from IHT have more than doubled in the last ten years to over £7 billion. That growth has been aided by a combination of a nil rate band frozen at £325,000 since 2009 and, in recent times, rampant inflation. Even the introduction of the residence nil rate band in 2017/18 (now frozen at £175,000 until April 2028) made little impression on the upward march of IHT revenue.

The history of inheritance tax

Inheritance tax is nothing new: it has existed in some form in the UK since 1780, the three most recent versions being estate duty (1894-1975), capital transfer tax (1975-1986) and inheritance tax (1986 to date). From the Treasury’s viewpoint, IHT, like its predecessors, is a particularly efficient tax. The number of estates that paid IHT in 2020/21 (HMRC’s latest statistics) is 27,000, with the average tax liability being £214,000.

Inheritance tax axe and how it will be compensated

This relatively small number of taxpaying estates and the large sums involved mean that HMRC can justify paying close attention to estate returns. A Freedom of Information response from HMRC in January 2023 underlined the impact of that scrutiny: in 2020/21 £326 million was “recovered” following over 4,000 “investigations”.

Given the current state of government finances, were IHT to be axed, then compensating for the lost income would entail adding about 1p extra on the basic rate of income tax or 4p on the higher rate. Alternatively, the standard VAT rate would need to go up to about 21%. If you compare how many people would be affected by such changes against the number who would benefit from the end of inheritance tax, the politics would seem to point towards continuing that 300-year plus tradition of estate taxes.

Disclaimer

Tax treatment varies according to individual circumstances and is subject to change.

The Financial Conduct Authority does not regulate tax advice or inheritance tax planning.

Get in touch

Fill in the form below and a member of the team will be in touch