How much does retirement cost?

How much does retirement cost?

New research has put some surprising numbers on the income needed in retirement.

Each year since 2019, the Pensions and Lifetime Savings Association (PLSA) has set about answering the question of how much retirement costs for couples and single retirees. It considers three different Retirement Living Standards, which are summarised as:

- Minimum: covers all your needs with some disposable income.

- Moderate: more financial security and flexibility.

- Comfortable: more financial freedom and some luxuries.

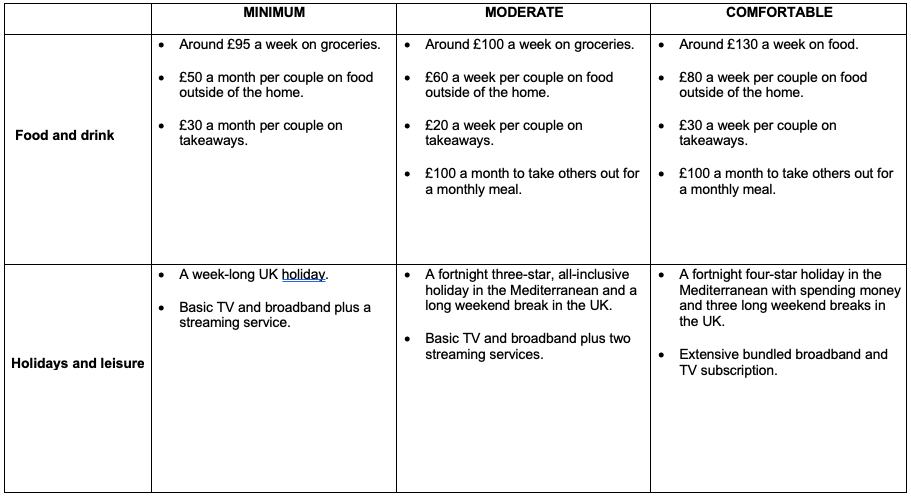

To give a more detailed idea of what the different standards imply, these are how two sub-categories break down for food and drink, holidays and leisure:

Changes to retirement living standards

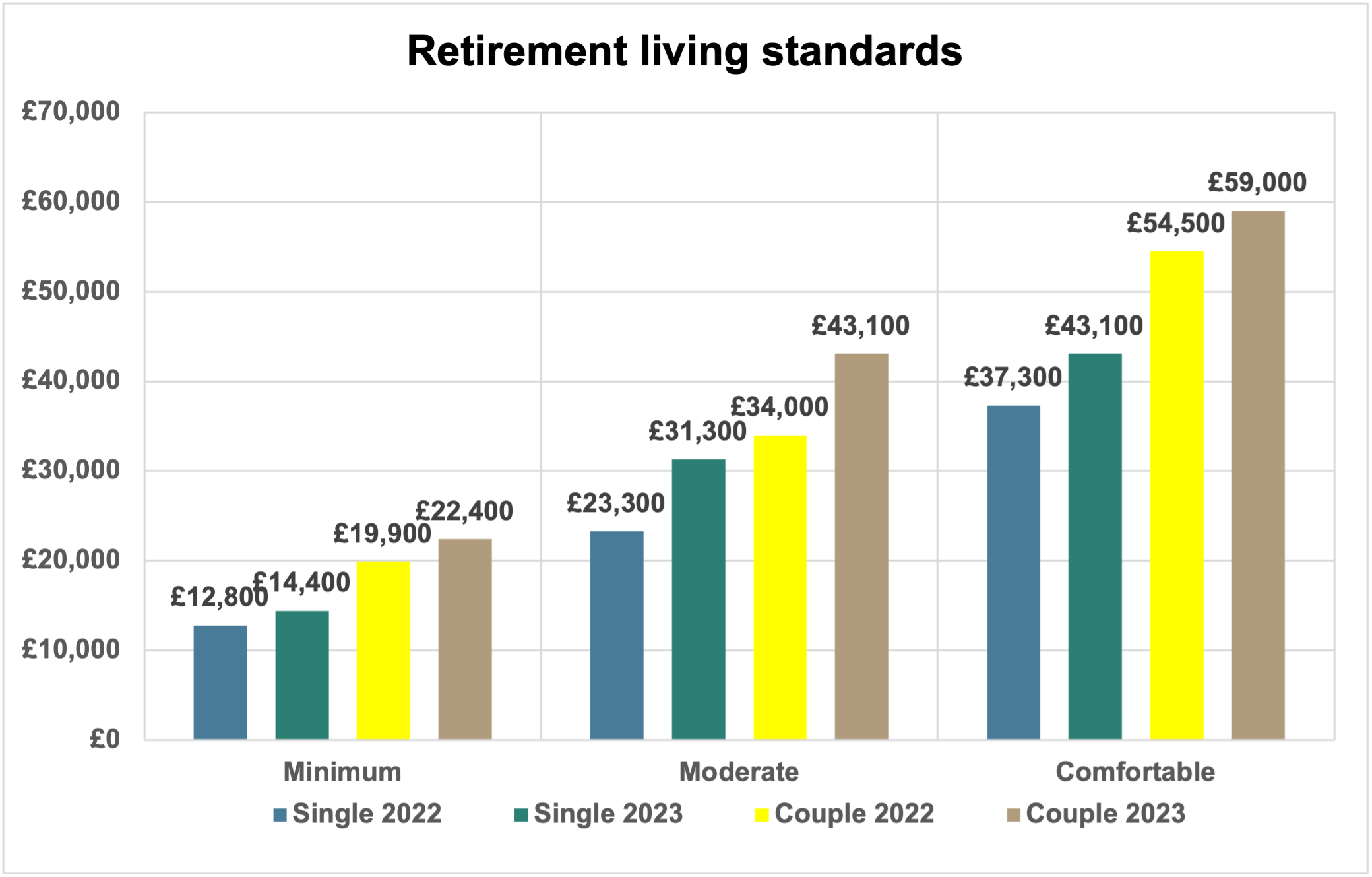

For the first time since 2019, the Moderate and Comfortable standards have been ‘rebased’ to allow for changed spending patterns. For example, out went two cars for the Comfortable standard and in came much higher spending on clothes in the Moderate standard. The rebasing means the gap between the 2023- and 2022-income requirements reflects more than just inflation – leading to the 34% jump for the Moderate single income requirement.

Retirement income requirements

The bottom-line costs shown in the graph below are net (after-tax) income requirements and take no account of any rental expenditure. As a reminder, from April 2024 the new State pension will be £11,502 a year.

Get in touch

Fill in the form below and a member of the team will be in touch