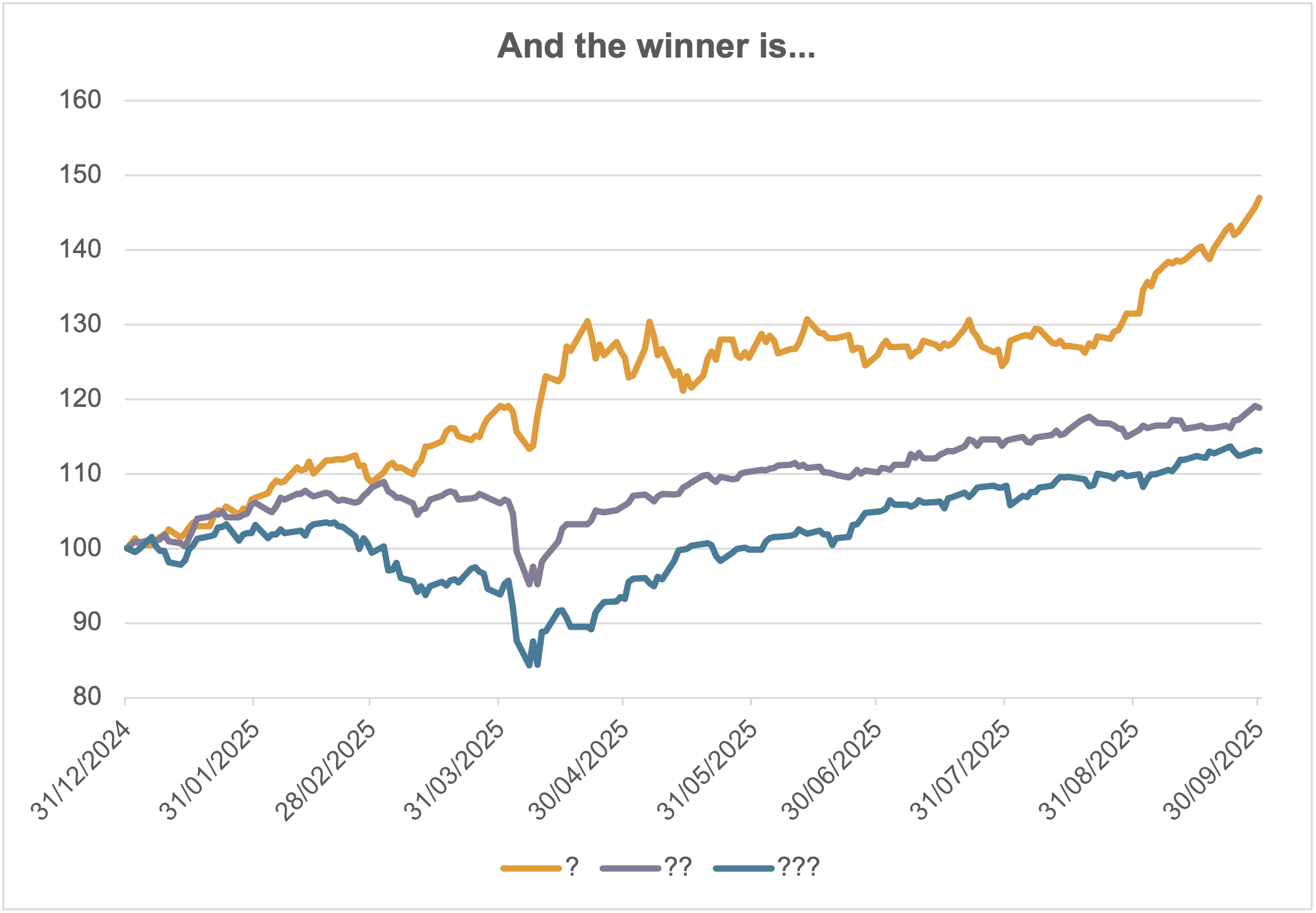

Nine months into 2025, investment performance may not be what you expect.

Source: Investing.com

WHAT’S BEING PLOTTED? A TRIO OF ETFS COMPARED

The daily blog from Financial Times, FT Alphaville, runs a competition every Friday for a trivial prize, such as a T-shirt. The quiz typically involves a trio of graphs with the same question applied to each one: what is being plotted? The answers are usually esoteric: two recent examples were an Argentinian government bond and two classes of debt from First Brands, a US car parts provider that had recently – and spectacularly – failed.

The graph above is more straightforward than FT Alphaville’s offerings. It shows for the first nine months of 2025:

• The price of a gold exchange traded fund (ETF),

• The price of a FTSE 100 ETF, with dividend income reinvested, and

• The price of an ETF linked to the S&P 500, the main US stock market, again with dividend income reinvested.

For consistency, the ETFs are all from the same provider, priced in US dollars and rebased to 100 at the end of 2024. Your challenge is simple: which is which?

THE RESULTS: GOLD OUTPERFORMS, S&P TRAILS

The answer is that the top performer (?) at the end of the third quarter of 2025 was the gold ETF (+47.0%). Second (??) was the FTSE 100 ETF (+18.9%), and bringing up the rear (???) was the S&P 500 ETF (+13.1%). If you are surprised that the US takes the wooden spoon, you are probably not alone.

WHY CURRENCY EXPOSURE MATTERS IN 2025

There are plenty of ways of explaining what has happened, but arguably they can be explained with a single word: dollar. In 2025, the shine has come off the US currency. Global investors have been unsettled by an environment in which tariffs of 25% or more can suddenly appear from a weekend message on Truth Social, Donald Trump’s social media company. As a result, there has been selling of the dollar or, for foreign owners of US shares, currency hedging against the dollar’s fall. Central bankers have also been less enthusiastic about holding the dollar in their reserves and instead have been paying more attention to – and buying – gold.

WHAT THIS MEANS FOR GLOBAL INVESTORS

For private investors, the message is that currency still matters and that, although the US stock market has been regularly hitting new highs, the benefits for investors outside the US have been watered down by the weakening dollar.