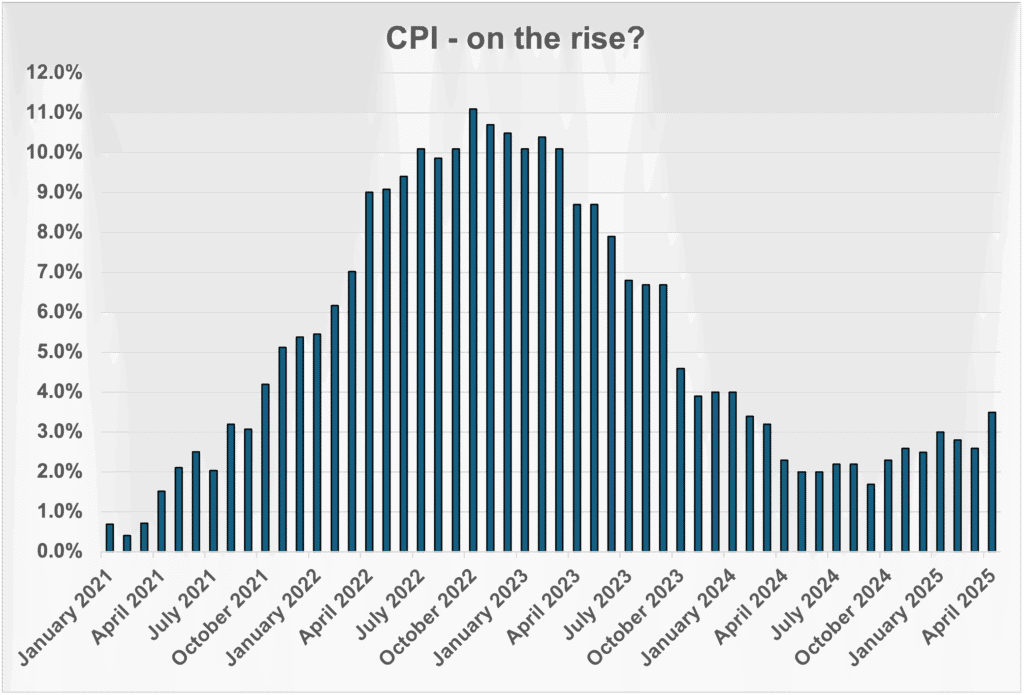

The April inflation figure was outside the Bank of England’s target range.

Source: Office for National Statistics

Why the Bank of England Governor Had to Write Again

The Bank of England’s annual inflation target, set by the Chancellor, is 2%, based on the Consumer Prices Index (CPI). If inflation is more than 1% on either side of the target, the Bank’s Governor is required to write to the Chancellor explaining what has happened and the actions being taken to bring CPI back within range. If inflation is still off-target three months later, the Governor must write another letter.

Until the April 2025 inflation figures were published, the last letter that the current Governor, Andrew Bailey, had to compose was in March 2024, when the February 2024 CPI was at 3.4%. By then Mr Bailey had become well practised at such correspondence, as inflation had been above 3% since August 2021.

What Drove April’s Inflation Surge?

This year’s jump in annual inflation from 2.6% in March to 3.5% in April, which prompted Mr Bailey’s latest letter, had been widely anticipated. The Bank of England’s papers, accompanying the May interest rate announcement, showed the Bank expected April inflation to be 3.4%, rising to a peak of 3.7% by September.

Utility Price Cap Increases Add Pressure

Ironically, the two main drivers of the 0.9% rise were closely linked to the Government. The largest contribution was the increase in the various regional utility price caps covering Great Britain, set by OFGEM, a non-ministerial Government department. The same governmental status applies to OFWAT, which raised water bills for England and Wales by an average of 26% (with wide regional variations). The utility price cap was especially problematic because the April 2025 increase of 6.4% replaced an April 2024 decrease of around 12%.

What This Means for Your Financial Plans

While the recent utility-driven jump in inflation isn’t currently expected to signal a longer-term trend, it follows on from the surge of inflation earlier this decade. Cumulatively, since the start of 2020, average prices have risen by 27.7%. Had inflation remained at a steady 2.0%, the rise would have been 11.1%. If your retirement plans had assumed 2% inflation, they may now need a review.