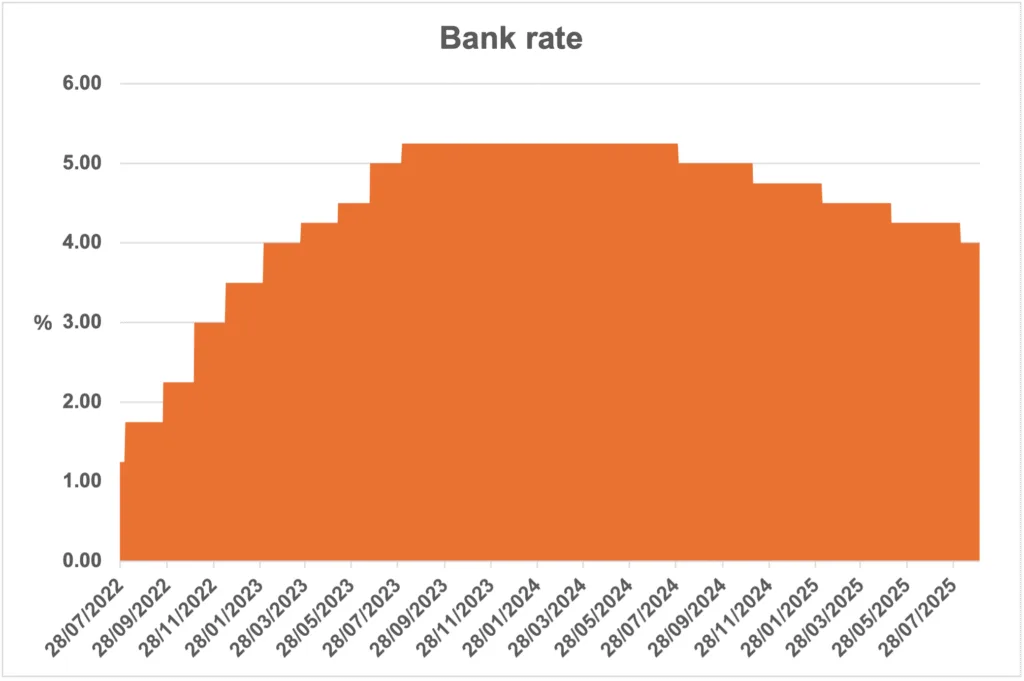

August’s cut in interest rates of 0.25% was far from straightforward and has implications for future moves.

Source: Bank of England

A HISTORIC MPC VOTE ON INTEREST RATES

The Bank of England was given independence to set interest rates in May 1997. Since then, the Bank Rate has been decided by a vote of the Monetary Policy Committee (MPC), which consists of nine members – five from the Bank and four externally appointed. At first sight, nine members should ensure that any vote achieves a majority, which was the case until 7 August 2025.

On that day, the first round of voting failed to produce a majority:

• Four MPC members voted to leave rates unchanged;

• Four MPC members voted to cut rates by 0.25%; and

• One MPC member voted to cut rates by 0.5%.

WHY A SECOND ROUND OF VOTING WAS NEEDED

The 4–4-1 result prompted a second vote, this time with the question being whether rates should be cut by 0.25%. The outcome was 5–4 in favour of the reduction, so the Bank Rate fell to 4%.

INFLATION, GROWTH AND THE BANK’S DILEMMA

The unprecedented second round of voting was not the only starring role for the figure of 4%.

INFLATION FORECAST RAISED TO 4%

The MPC’s minutes showed that the Bank had increased its estimate of peak consumer prices index inflation to 4%, arriving in September 2025. It is unusual for a central bank to cut rates in the face of rising inflation, but not as rare as a second MPC vote.

UK ECONOMIC GROWTH REMAINS WEAK

The Bank, like the Chancellor, is concerned about the weakness of the economy, which grew by only 0.3% in the second quarter. At the margin, lower interest rates should give the economy a boost. As for inflation, the Bank is ‘looking through’ the autumn rise and projecting that inflation will “fall back thereafter towards the 2% target”. It blames the move upwards on “developments in energy, food and administered [e.g. utility] prices”.

WHAT’S NEXT FOR UK INTEREST RATES?

What does all this mean for the future of interest rates? The MPC offers an evasive answer, saying “policy is not on a pre-set path, and the Committee will remain responsive to the accumulation of evidence.” The majority of the MPC will likely want to see the Budget’s contents in the autumn before making any further moves.

IMPLICATIONS FOR INVESTORS AND SAVERS

In the meantime, income yields on medium- and long-term government bonds look attractive, having risen to levels not seen in over 15 years.